Claims of market manipulation drive national concern over fertilizer industry consolidation.

On a small vegetable farm in Georgia, Shad Dasher used to grow watermelons every year.

Last year, he didn’t plant any.

Dasher, 56, said it was because of elevated fertilizer prices. Like many farmers, Dasher is finding it hard to stay afloat. “The American public just doesn’t understand what kind of beating our group (of farmers) has been taking over the years,” he said.

Although fertilizer prices have fallen from their all-time high in March 2022, when they spiked up to 3.5 times higher than two years before, the commodity is likely to remain costly for some time, continuing to squeeze the food production system.

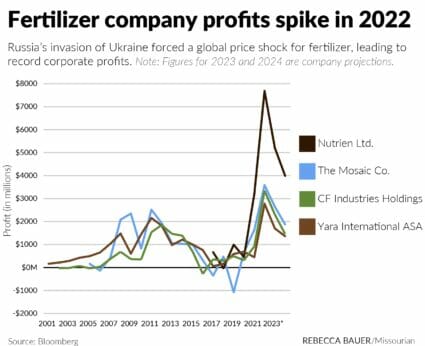

Meanwhile, the fertilizer industry has yielded record profits. Canada-based Nutrien Ltd., the world’s leading producer of potash fertilizer, saw profits increase 1575 percent between 2020 and 2022, to $7.7 billion. Florida-based Mosaic Co., one of the largest US producers of potash and phosphate fertilizer, netted $3.6 billion in 2022, a 438 percent increase from 2020. CF Industries, an Illinois-based fertilizer company, made $3.2 billion in 2022, a 955 percent increase from 2020.

The eye-popping figures have heightened concerns about consolidation in the fertilizer industry, even as the Biden Administration moves to boost domestic fertilizer production.

When asked for comment, Mosaic said in an email that the fertilizer business is cyclical and thus has volatility in prices. CF Industries did not respond to requests for comment. Nutrien did not provide a statement by press time.

Global disruptions help drive up prices

There are a few clear reasons for the recent record fertilizer prices. The onset of the COVID-19 pandemic in 2020 caused disruptions to the supply chain and labor shortages that hindered production of natural gas, a major ingredient in fertilizer.

Then came a series of natural disasters, such as the February 2021 deep freeze in Texas, which froze natural gas wells and drove up demand for residential heating. In August that year, Hurricane Ida disturbed natural gas and fertilizer production in the Southeast.

Another factor was a reduction in exports from China, the world’s leading producer of phosphate, a chemical element that is a key component of fertilizer.

The war in Ukraine further tightened the market as Western countries sanctioned Russia, the world’s top fertilizer exporter. Disruptions in natural gas flow from Russia led to spikes in European natural gas prices and forced several European fertilizer plants to close or cut output.

Even low water levels on the Mississippi River contributed to price increases, as it limited the amount of fertilizer that could be shipped by barge.

“There were a myriad of reasons why we were seeing this big run up in fertilizer prices. It’s not just one thing. It was literally a whole menu of things that were seemingly going in the wrong direction if you were looking to obtain fertilizer,” said Chad Hart, an agricultural economist at Iowa State University.

Several of these factors are referenced in a study Hart co-authored that was hailed by The Fertilizer Institute for providing “the best analysis data will allow to date.” But some argue the study omits a large factor of the price increase: market power as a result of consolidation.

Allegations of market manipulation

Farm Action is a Missouri-based nonprofit organization that advocates for competitive food and agriculture systems across the United States. Co-founder Joe Maxwell believes consolidation in the fertilizer industry has led to market manipulation.

Since 1980, the number of fertilizer firms in the United States has fallen from 46 to 13. In 2019, just four corporations represented 75 percent of total domestic fertilizer production: CF Industries, Nutrien, Koch and Yara-USA, according to Farm Action. And just two companies supply 85 percent of the North American potash market: Nutrien and Mosaic, according to the Federal Trade Commission.

“These companies took advantage of their dominant position in a marketplace and increased commodity price to the farmers in an effort to price gouge and extract all the wealth that they could from that supply chain at the very roots: fertilizer,” Maxwell said.

[RELATED: Facing High Fertilizer Costs, Farmers Still Struggle to Use Less]

In 2021, the United States imposed tariffs on fertilizer imports from Morocco and Russia following petitions from Mosaic and CF Industries. Growers widely derided the move. A letter from the National Corn Growers Association to Mosaic accused the company of “irresponsible” practices that “manipulate the supply curve” and “dictate price to farmers.”

Later that year, Farm Action wrote a letter to the Antitrust Division of the Department of Justice accusing the fertilizer industry of using its “monopoly power” to fix prices, requesting an investigation. Iowa Republican Sen. Chuck Grassley seconded that call, but no investigation has yet been announced.

Mosaic said in an emailed response that since the tariffs took effect, foreign producers importing fertilizer into the North American market has increased, and by extension, made the market more competitive.

In a company Q&A, a Mosaic official, Andy Jung, said the tariffs are not the reason for the price increase and that the current market is not driven “merely by a ruling for fair trade.”

The effect of consolidation

President Joe Biden issued an executive order in 2021 promoting competition in the economy, including the agriculture sector and the fertilizer industry specifically. “Consolidation in the agricultural industry is making it too hard for small family farms to survive,” the order reads.

In response to the order, the US Department of Agriculture collected comments from agricultural producers on competition, access to fertilizer and supply chain concerns. From more than 1,600 responses, 72 percent described concerns about the power of fertilizer manufacturers and 62 percent described what they saw as unfair price-setting practices.

While the study from Iowa State University does acknowledge market consolidation, it dismisses it as a factor of price increase. Hart said he sees the consolidation, but can’t prove manipulation in such an unstable time.

“You just can’t separate out what’s happening and whether there is a competition problem in this market or not,” Hart said.

While many factors have made the ingredients for fertilizer more expensive, the increase in profits is disproportionate to the increase in production costs – basically, companies are making a lot more money than they’re spending.

In 2022, Nutrien’s cost of goods sold increased by 24 percent compared to the year prior; however, its profits were up 142 percent from 2021. CF Industries saw its profit increase by 212 percent in 2022, while the cost of manufacturing and sales was only up 28 percent. For Mosaic, profits were up 120 percent in 2022, but cost of sales only increased by 46 percent.

Although corn farmers enjoyed the highest corn prices on record in September 2022, their profits were offset by increased fertilizer prices.

“These [fertilizer] corporations are well aware of their leverage and have used the cover of consecutive global crises to raise prices far beyond those demanded by necessity,” Farm Action said in a comment to the USDA.

Farming communities hit hardest

Small farmers, business owners and rural communities have struggled to pay bills amid these record costs and industry profits.

Gary Hamilton owns a small business in northeast Missouri called Frankford Farm Supply, where he sells fertilizer and farming equipment. He started the company about 30 years ago.

Hamilton’s store is down the road from one of many corporate-owned Nutrien stores scattered across rural America. Hamilton said that Nutrien’s prices are lower and he just can’t compete as a small family-owned business with less than 15 employees.

When fertilizer prices go up, Hamilton’s credit limit doesn’t. This means he may not be able to serve as many customers as he used to, and those customers have to turn to other stores.

“Because of the high prices, I actually lose business. And when I lose business, then I have less money to pay for health insurance, fuel, salaries, wage increases, day-to-day things that businesses need to survive,” Hamilton said.

Fertilizer prices are expected to fall eventually, with lower demand from farmers helping to rebuild supply, experts say. But it will be hard to lessen dependence on fertilizer anytime soon. While farmers and small business-owners may complain about fertilizer prices, they will continue to pay for it, Hart said, because their business—and the food supply—depends on it.

This story is part of The Price of Plenty, a special project investigating fertilizer from the University of Florida College of Journalism and Communications and the University of Missouri School of Journalism, supported by the Pulitzer Center’s nationwide Connected Coastlines reporting initiative and distributed by the Mississippi River Basin Ag & Water Desk.

Good practice and good think

Interesting articles keep posting more!