Monsynto? Synganto?

That mission: take over and subsume its European rival, the Swiss corporation Syngenta, and create what would easily be the largest company in the history of agribusiness. Syngenta has so far resisted the merger, but Monsanto continues to put on the pressure. What does a Monsanto-Syngenta (Mongenta? Synsanto?) mean for the world of agriculture?

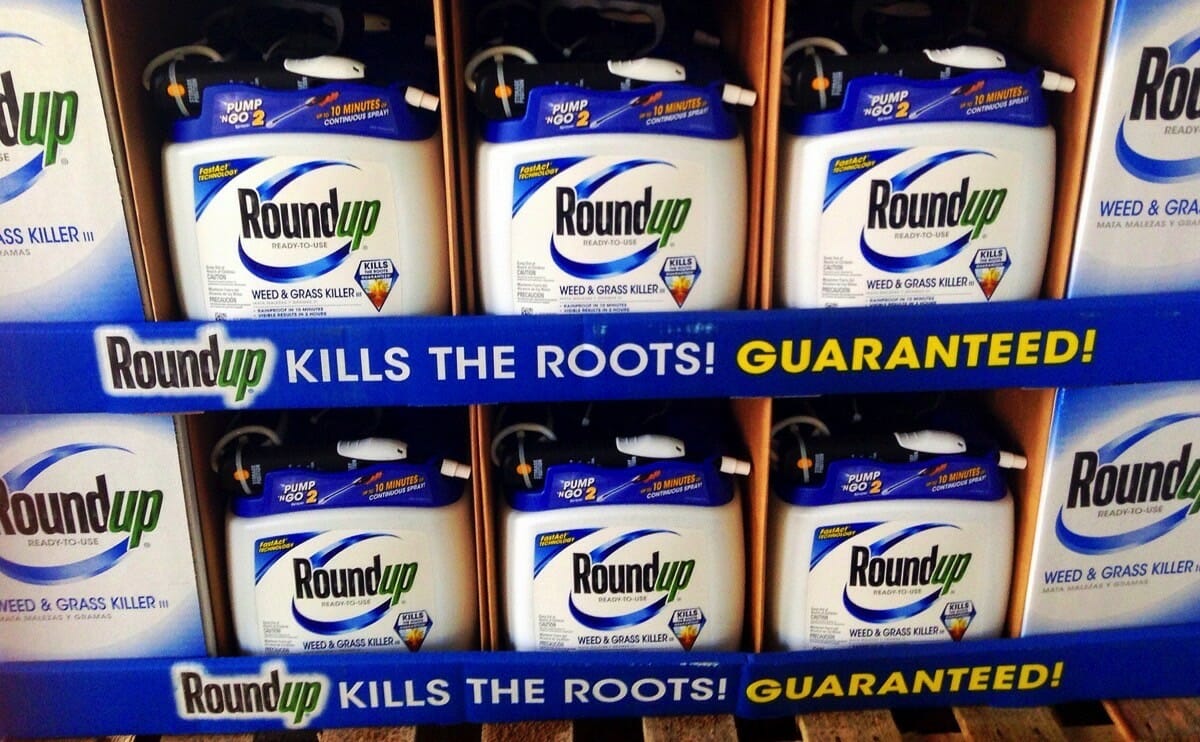

Monsanto made its mark with the insanely popular herbicide Roundup, and then throughout the 1990s acquired dozens of genetically modified seed companies, figuring out a way to engineer seeds that were resistant to Roundup. Monsanto currently sells 35 percent of all corn seeds in North America, according to the Wall Street Journal.

Syngenta is a similar company with a similar dominance of the market in Europe, though it has a slightly different focus than Monsanto. Both companies do a bit of everything, but Monsanto is primarily a seed company that also creates and sells agricultural chemicals, whereas Syngenta is primarily a chemical company (pesticides, mainly) that also sells seeds.

Since early June, Monsanto has been aggressively attempting to take over Syngenta, offering repeatedly to purchase its stock at a significant markup. If the deal goes through, Monsanto pledged to sell off Syngenta’s seed business to lessen the chance of an antitrust lawsuit. Syngenta has bluntly rejected the offer, which amounts to around $45 billion, repeatedly, despite some sweeteners from Monsanto like a name change for the new company and a $2 billion payoff if, after the takeover, EU or U.S. antitrust laws break it up. Syngenta has not budged.

A 2015 Harris Poll study of the reputation of corporations ranked Monsanto 97th out of 100; Halliburton and BP are both found to have better reputations. There are already petitions set up to protest the merger; one says, “This is the deal that could create the ultimate supervillain.”

The concerns are partially the same as with any massive takeover: by reducing competition, a Monsanto/Syngenta hybrid could jack up prices and control the market more effectively than ever before. And fears are greater because the market in question literally produces the food on our table.

Some farmers quoted by the Journal are a little more measured; they think they may be able to get some deals on bundled seeds and chemicals if the same company sells both.

Regardless, Syngenta has shown no signs of accepting the current deal, stating that the offer is too low and that Monsanto is underestimating the regulatory hurdles the new company would have to go through. That doesn’t mean Syngenta isn’t interested, of course. We’ll keep you updated as more news breaks on the possible takeover.

Image via Flickr user Mike Mozart